Digital Lending FAQs

Powered by our proprietary technology platform, the nordIX European Consumer Credit Fund is one of the largest fintech-oriented capital providers in Europe, providing liquidity for consumer loans.

Frequently asked questions

Consumer credits

What types of consumer credits are there?

Consumer loans can be divided into different types, including installment loans, buy now pay later (BNPL) products, car loans and overdrafts.

One of the most common forms is installment loans, which are usually used for larger purchases such as cars, furniture or household appliances. With an installment loan, the borrower pays back the loan in regular installments over the agreed term of the loan.

Another form of consumer credit is the so-called overdraft facility. This type of loan allows the borrower to withdraw more money from their current account than is actually available, up to a limit set by the lender. Overdrafts are flexible and can help the borrower bridge short-term financial shortfalls, but they often have higher interest rates than other types of loans.

Buy Now Pay Later (BNPL) is another form of consumer credit that has recently gained popularity. With this type of credit, the consumer buys a product or service immediately but only pays at a later date, often in several installments and sometimes even without interest if the installments are paid on time.

In addition, there are specific consumer credits such as car loans or student loans that are intended for specific purposes. Overall, consumer loans are an essential financial tool for many consumers who need to make certain purchases but do not have the necessary funds available. However, it is important that borrowers carefully consider their financial situation and their ability to repay the credit before taking out a consumer credit to avoid financial difficulties in the future.

For what purpose are consumer credits granted?

Consumer credit can be used for a variety of purposes, including the purchase of consumer goods, electronics, vehicles and even to finance sustainable products such as wallboxes for electric cars, solar panels and bicycles. The promotion of such sustainable products has become increasingly important in recent years as more and more people seek to reduce their ecological footprint.

Which market participants characterize the consumer credit industry?

The consumer credit industry in Europe is a diverse and dynamic field characterized by a number of different market participants. These market players acting as lenders include traditional banks, peer-to-peer (P2P) lending platforms and Buy Now Pay Later (BNPL) providers. BNPL provider Klarna has experienced a meteoric rise in recent years. In 2022, Klarna had a gross merchandise volume of SEK 837 billion.

Historically, traditional banks were the dominant players on the consumer credit market. Today, traditional banks still have an overwhelming market share. They offer a wide range of credit products tailored to the specific needs of consumers, including installment loans, car loans and overdrafts. Traditional banks usually have strict lending criteria based on the creditworthiness of the borrower. This ensures them a high level of trust and stability. But the landscape is changing.

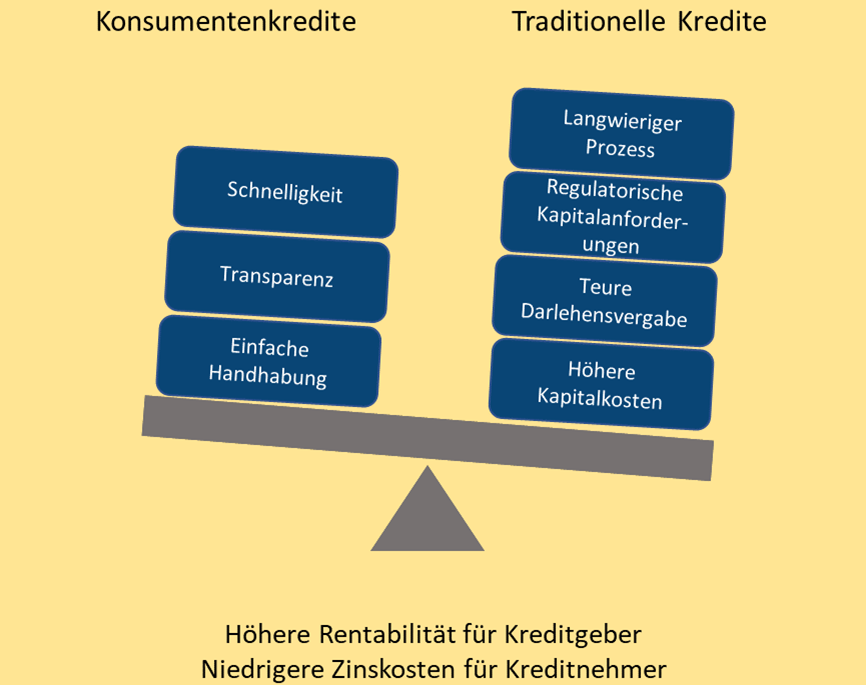

With the advent of digitalization and the rise of fintech companies, new types of lenders have emerged. Peer-to-peer (P2P) lending platforms, which connect lenders and borrowers directly, are one example. By using technology and algorithmic models to assess risk, P2P platforms can often lend faster and more flexibly than traditional banks. In addition, they can often offer higher returns for lenders and lower interest rates for borrowers as they have lower operating costs.

Another recent development in the consumer credit market is the rise of Buy Now Pay Later (BNPL) providers. BNPL products allow consumers to make a purchase immediately and spread the cost over a series of installments. This model has become particularly popular in online retail, where it allows customers to finance their purchases without having to resort to traditional credit cards or bank loans. BNPL providers such as Klarna, Afterpay and Affirm have experienced significant growth in recent years and have taken on a significant role in the European credit market.

Although these new types of lenders have diversified the consumer credit market and increased consumer choice, they also bring new challenges and risks. For example, P2P platforms and Buy Now Pay Later providers may be less regulated than traditional banks, which could lead to increased risks for consumers. In addition, the algorithmic credit scoring models used by some of these new players could encourage discriminatory or unfair lending practices.

Overall, the consumer credit market in Europe shows a growing diversity of market participants, each bringing their own benefits and challenges. In this dynamic landscape, it is important that consumers are well informed and make responsible lending decisions. At the same time, regulators must remain vigilant to ensure that all market participants comply with fair and transparent lending practices.

What is the size of the consumer credit market?

The consumer credit market in the eurozone had a volume of €721.1 billion in April 2023 (1). In comparison, the consumer credit market in Germany had a volume of 184 billion euros at the end of 2021 (2). The members of the banking association held 58% of this market. Forecasts for the eurozone show that the credit volume could rise to 741.1 billion euros by 2025 (1).

Sources:

1.ECB Datawarehouse

2. banking association

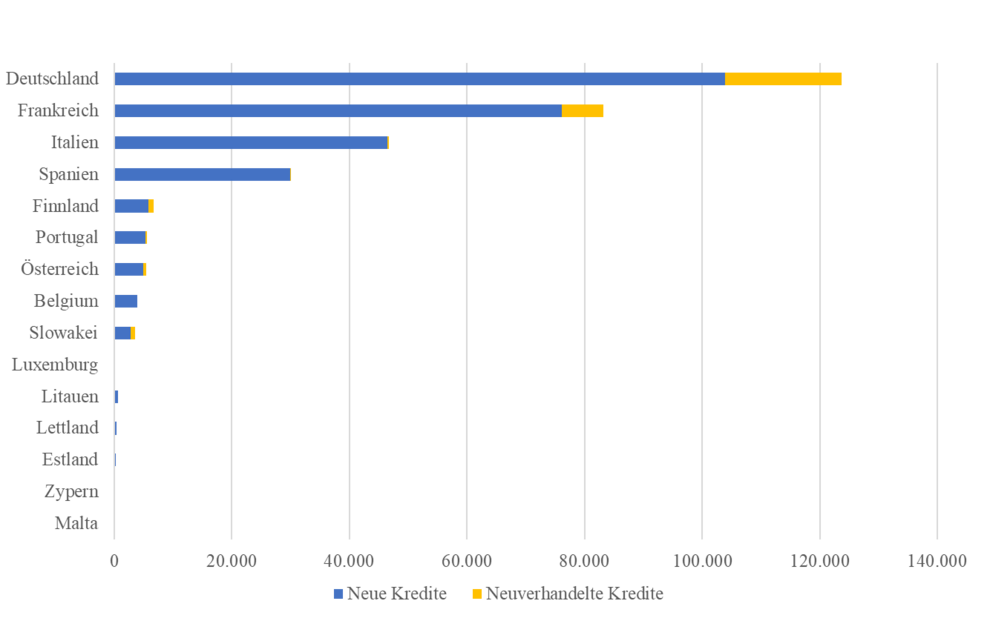

What is the distribution of volumes by country?

Germany and France have the highest growth in consumer loans for 2022. At the same time, the two countries are also the leaders in terms of the outstanding volume of consumer loans.

Volume of consumer loans issued in selected eurozone countries in 2022, by type (in millions of euros)

How are consumer loans documented?

To comply with regulatory requirements, lenders must keep comprehensive documentation on all consumer loans. This documentation must include both the terms and conditions of the loan and the borrower's payment history. In addition, the documentation of consumer credit in the EU is strictly regulated by the Consumer Credit Directive. Lenders are obliged to provide detailed pre-contractual information and to use the European standardized credit information form. This ensures transparency and enables consumers to effectively compare credit offers.

What are consumer credits?

Consumer credits, also known as installment loans, are financial resources provided by banks or other lenders to individuals to cover certain types of personal, family or household-related expenses. Unlike commercial or industrial loans, which are usually used for investments in businesses, consumer loans are used to finance consumer goods and services.

A characteristic feature of consumer loans is that they are usually repaid in fixed, regular installments over a certain period of time. The exact terms of the loan, including the interest rate, the term and the amount of the monthly payments, are agreed between the lender and the borrower at the time the credit is granted.

Marketplace Lending

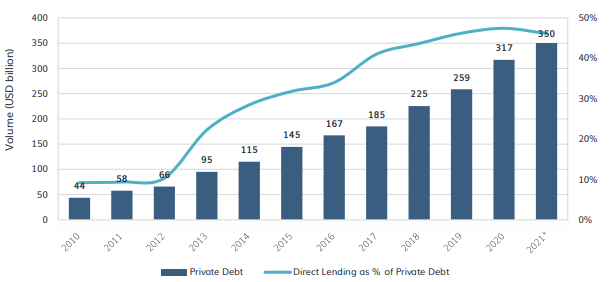

How is direct lending developing?

Through the development of e-commerce and the processing of large amounts of data, the model of lending via online platforms has developed efficient and convincing methods to quickly and accurately assess and categorize the credit risks of borrowers. The platforms generally use multi-level credit and risk assessment models to evaluate the creditworthiness of borrowers.

The platforms often charge fees to their lenders for the services they provide, including checking the creditworthiness and criteria of borrowers, managing the supply and demand of consumer credits and processing payments and collecting debts (servicing).

As a result, lenders and borrowers of consumer credits generally share the profit that a traditional bank would normally generate as an intermediary.

What are successful examples of marketplace lending?

Neofinance and Savelend are two notable examples of the success of MPL platforms in Europe. Neofinance, based in Lithuania, offers a platform that provides a seamless experience for borrowers and investors. Their user-friendly interface and built-in security measures have made them a popular choice for many.

Savelend, a Swedish MPL platform, has also found success by allowing investors access to a wide range of loan offerings. Their platform is designed to offer investors a high rate of return while protecting them from excessive risk. In some cases, the platform offers to buy back defaulted loans at 100% of the defaulted debt.

In addition to simplifying the lending process, MPL platforms also contribute to the democratization of the financial sector. They open the door for a broader section of the population to access loans and investment opportunities that were traditionally only available to a smaller group of people.

The innovation and potential shown by MPL platforms such as Neofinance and Savelend are proof of the positive impact these types of platforms can have on the financial sector in Europe. They are a shining example of how technology can be used to make financial services more efficient, accessible and profitable.

Direct Lending

European Consumer Credit Directive (ECCD)

What is European Consumer Credit Directive?

The European Consumer Credit Directive (ECCD) is an important regulatory instrument that aims to harmonize consumer protection for credit agreements within the EU. It was adopted in 2008 and applies to credit agreements between 200 and 75,000 euros. The Directive covers a wide range of aspects of the consumer credit market, including disclosure requirements, calculation of the annual percentage rate of charge, pre-contractual information, right of withdrawal, advertising and early repayment.

The ECCD sets out strict requirements for the disclosure of information. Lenders are required to provide potential borrowers with full and transparent information about the terms and costs of a loan. This is intended to help consumers make informed decisions and avoid loans they cannot afford. An important feature of the ECCD is the introduction of the Standardized European Credit Information Form (SECCI), which obliges lenders to provide detailed information to potential borrowers.

A key aspect of the ECCD is the requirement to calculate the annual percentage rate of charge (APR). This includes all costs of the loan, including interest and fees, and provides a standardized comparison value. The introduction of a uniform APR across all EU member states makes it easier for consumers to compare offers and choose the best deal. The ECCD also ensures that consumers have sufficient time to check the terms and conditions of a loan. It sets out a minimum level of pre-contractual information that a creditor must provide and stipulates that the consumer can withdraw from a credit agreement within 14 days without giving a reason. In addition, consumers have the right to repay a loan early at any time.

How is the ECCD developing?

The ECCD also has an impact on credit scoring. The directive obliges creditors to check the creditworthiness of consumers before concluding a credit agreement. This step is intended to help prevent excessive indebtedness and payment defaults. The ECCD has harmonized the consumer credit markets in Europe and created a uniform legal framework. It has contributed to greater transparency and fair competition in the sector and given consumers more rights and protection. However, implementation in the individual EU member states has led to some differences in the application of the directive. Therefore, a revision of the ECCD has been discussed to improve its effectiveness and ensure that it continues to provide a high level of consumer protection. Despite the benefits and protection offered by the ECCD, there are also challenges and criticisms. Some critics point out that despite the harmonization of regulation at EU level, there are still significant differences between national consumer credit markets. This could be due to the fact that the directive leaves room for national interpretation, which leads to differences in implementation. Another point of criticism concerns the scope of the ECCD. As the directive covers loans between 200 and 75,000 euros, many forms of credit, such as payday loans or microloans, which fall below this threshold, are not covered by its protection. There have therefore been calls to extend the scope of the ECCD to cover a wider range of credit products and ensure greater consumer protection.

The European Commission has published new guidelines in 2022. As expected, the guidelines cover buy-now-pay-later products, loans under 200 euros and crowd-lending. These are now treated in the same way as all other loans. Further conditions have also been added to the guidelines. The borrower must demonstrate to the platform that they have the necessary means to repay the loan. In addition, they must be informed exactly what costs they will incur and how high their repayments will be. The quality of the information provided to consumers is also criticized. The information provided to borrowers is not always clear and is often complex, particularly the information on the costs of the loan and the consequences of non-payment. Accordingly, the aim is to improve pre-contractual information by requiring lenders to focus more on key information such as the interest and costs of the loan, the APR and the total amount of the loan. A reflection period for consumers is also to be introduced. This provides for a reflection period of one day before concluding the loan agreement or a digital reminder of the right of withdrawal before the deadline expires.

In addition, there are concerns about the ECCD's ability to keep pace with rapidly changing trends and innovations in the financial sector. With the growth of online and mobile credit and the development of new credit products, the Directive needs to be constantly reviewed and updated to ensure that it continues to provide effective consumer protection. Despite these challenges, the ECCD remains an important tool for consumer protection in Europe's credit markets. It provides a framework for fair and transparent lending practices and ensures that consumers have the necessary information to make informed decisions. Its future development and adaptation will be crucial to ensure that it continues to provide effective protection for consumers and contributes to strengthening consumer confidence and the stability of credit markets.